Graphite represents a key battery anode material and one of only four critical minerals highlighted by the US Geological Survey as essential to all six industrial sectors. Despite its importance, the US has no domestic production of graphite and is therefore 100% dependent on imports.

S&P Global estimates that the country imports nearly half of its supply from China, its main rival and the dominant player in the global graphite supply chain, accounting for 77% of the world’s mine production.

Graphite One’s strategy

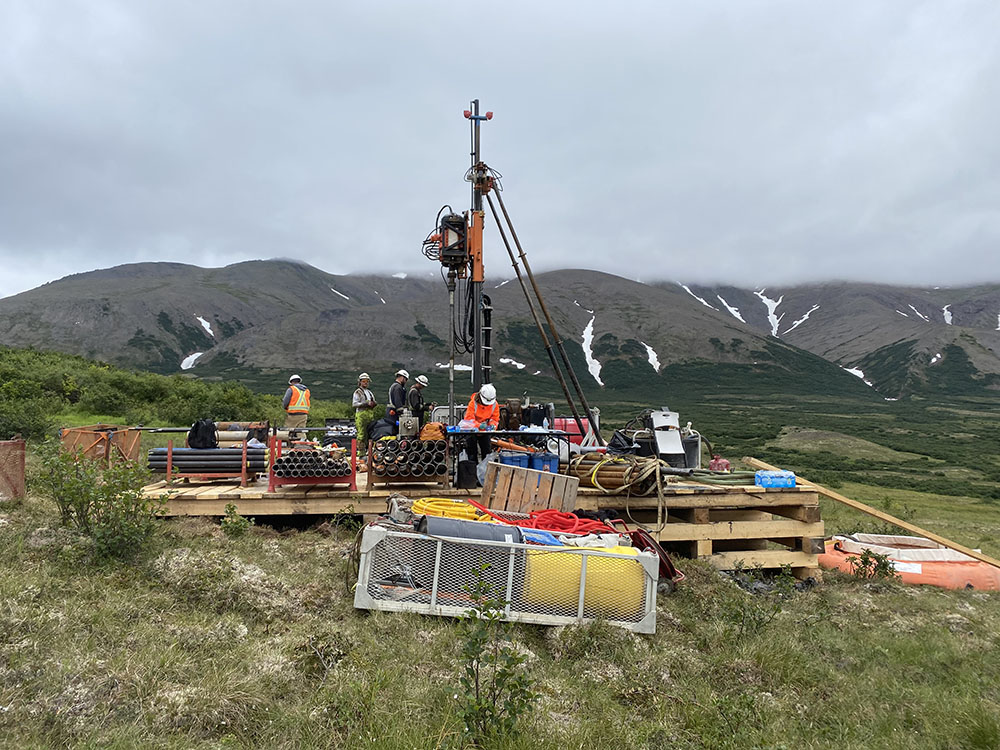

Vancouver-based Graphite One is positioned to mitigate China’s dominance by developing an advanced graphite supply chain that is vertically integrated and completely US-based. Its proposed project is anchored by what it considers to be the nation’s largest and highest-grade graphite deposit, Graphite Creek in Alaska, supplemented by an anode active materials (AAM) manufacturing plant located in Ohio.

A 2022 prefeasibility study projected that the entire operation would produce 75,026 tonnes of advanced graphite products per year over a 26-year life. The project has a post-tax net present value of $1.36 billion before accounting for tax credits enacted by the US Inflation Reduction Act.

The PFS assumes that the AAM manufacturing site will initially use purchased synthetic graphite, then incorporating natural graphite material once the Graphite Creek mine enters production. For the AAM plant, the company has already secured a 50-year lease agreement, including an option to purchase the property once known as Warren Depot, which was part of the National Defense Stockpile infrastructure the last time the US mined graphite.

US backings

In a letter of interest dated Oct. 18, the EXIM states that it is in support of the proposed capital funding plan by Graphite One for the AAM manufacturing facility located in Ohio’s Voltage Valley, which is expected to cost $435 million for the initial phase.

“Based on the preliminary information submitted regarding expected US exports and US jobs supported by this project, EXIM may be able to consider potential financing of up to $325 million of the project’s costs with a repayment tenor of 15 years under EXIM’s ‘Make More in America’ initiative,” the EXIM stated in its letter.

Construction of the facility is expected to commence within three years. While the site’s existing power lines are sufficient for Phase 1 production target of 25,000 tonnes per year of battery-ready anode material, an expansion into the Warren Depot site could accommodate 100,000 tonnes of production annually.

“EXIM’s potential financing, following on G1’s two Department of Defense grants under the Defense Production Act and from the Defense Logistics Agency, underscores the urgent need to bring US graphite supply into production, and end the nation’s 100% foreign dependency,” commented Anthony Huston, CEO of Graphite One.

The EXIM has also indicated that the financing may be eligible for for opportunities under the CTEP initiative, given China’s dominance in graphite.

Upon receiving EXIM’s letter, Graphite One intends to submit a formal application in 2025, after which the EXIM will conduct all requisite due diligence before making a final financing commitment.

The company also intends to make a production decision on its graphite project upon completion of its feasibility study, which is expected in the first quarter of 2025.

This article was published by: Jackson Chen

Visit the original article here